What Is The State Income Tax In Iowa . the state of iowa requires you to pay taxes if you are a resident or nonresident who receives income from an iowa source. The hawkeye state has sales taxes near the national. iowa state income tax tables in 2021. in 2023, iowa will have four income tax brackets — and which bracket you fall into will affect when your tax rate will lower to 3.9%. Iowa's highest income tax bracket is lower than in many other states, but some. The income tax rates and personal allowances in iowa are updated annually with new tax. iowa has a graduated state individual income tax, with rates ranging from 4.40 percent to 5.70 percent. smartasset's iowa paycheck calculator shows your hourly and salary income after federal, state and local taxes. last updated 28 february 2024. iowa has a progressive tax system that features a top marginal income tax rate of 6%.

from handypdf.com

The hawkeye state has sales taxes near the national. The income tax rates and personal allowances in iowa are updated annually with new tax. iowa state income tax tables in 2021. iowa has a graduated state individual income tax, with rates ranging from 4.40 percent to 5.70 percent. last updated 28 february 2024. smartasset's iowa paycheck calculator shows your hourly and salary income after federal, state and local taxes. Iowa's highest income tax bracket is lower than in many other states, but some. iowa has a progressive tax system that features a top marginal income tax rate of 6%. the state of iowa requires you to pay taxes if you are a resident or nonresident who receives income from an iowa source. in 2023, iowa will have four income tax brackets — and which bracket you fall into will affect when your tax rate will lower to 3.9%.

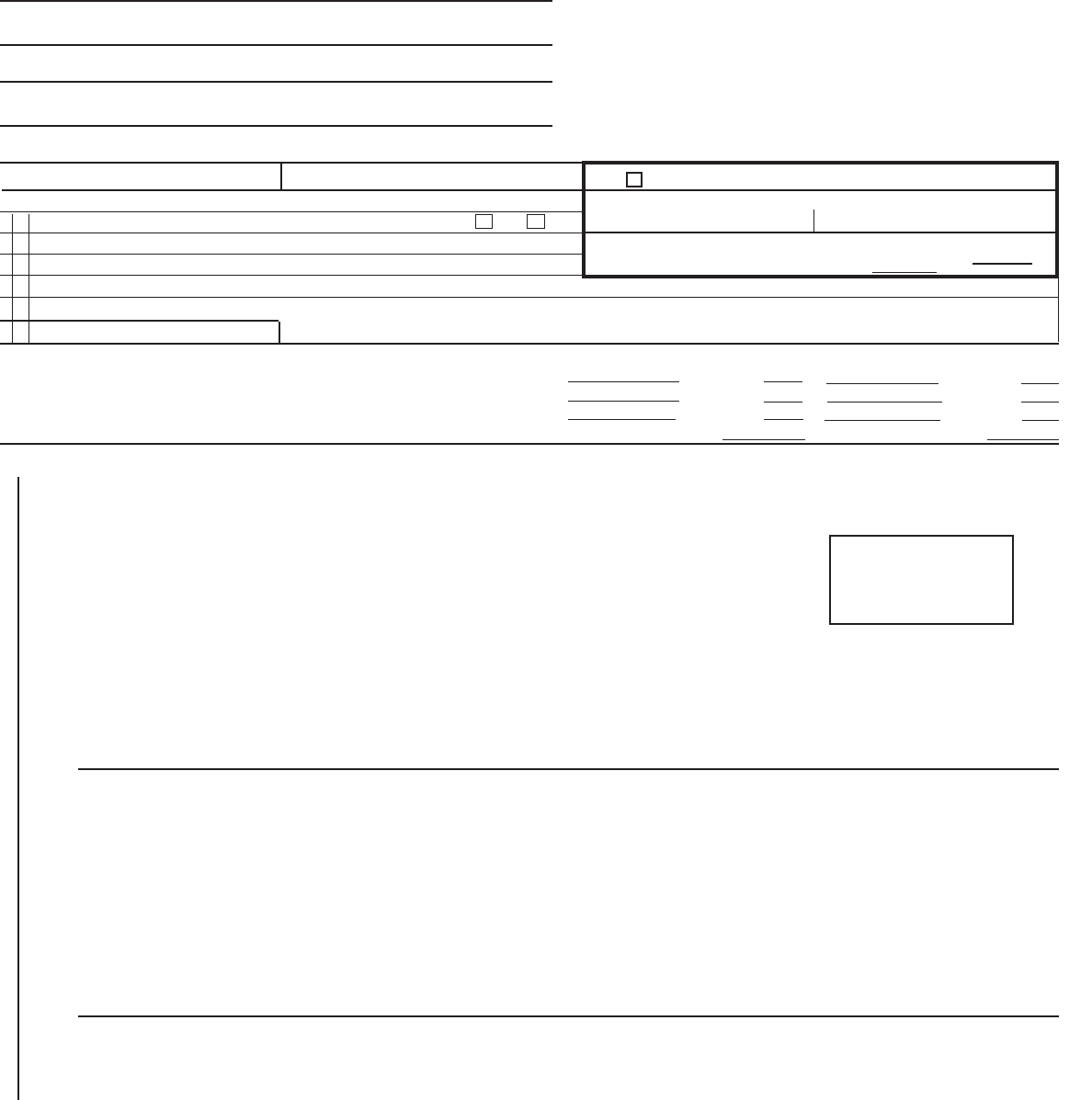

Iowa Individual Tax Form 2007 Edit, Fill, Sign Online Handypdf

What Is The State Income Tax In Iowa Iowa's highest income tax bracket is lower than in many other states, but some. The hawkeye state has sales taxes near the national. iowa has a progressive tax system that features a top marginal income tax rate of 6%. iowa state income tax tables in 2021. last updated 28 february 2024. smartasset's iowa paycheck calculator shows your hourly and salary income after federal, state and local taxes. The income tax rates and personal allowances in iowa are updated annually with new tax. Iowa's highest income tax bracket is lower than in many other states, but some. in 2023, iowa will have four income tax brackets — and which bracket you fall into will affect when your tax rate will lower to 3.9%. the state of iowa requires you to pay taxes if you are a resident or nonresident who receives income from an iowa source. iowa has a graduated state individual income tax, with rates ranging from 4.40 percent to 5.70 percent.

From www.signnow.com

Iowa Corporation Short Form Tax Return State of Iowa Fill Out What Is The State Income Tax In Iowa The hawkeye state has sales taxes near the national. The income tax rates and personal allowances in iowa are updated annually with new tax. last updated 28 february 2024. iowa state income tax tables in 2021. smartasset's iowa paycheck calculator shows your hourly and salary income after federal, state and local taxes. Iowa's highest income tax bracket. What Is The State Income Tax In Iowa.

From www.kcci.com

GOP bill seeks to gradually eliminate state tax in Iowa What Is The State Income Tax In Iowa in 2023, iowa will have four income tax brackets — and which bracket you fall into will affect when your tax rate will lower to 3.9%. iowa has a graduated state individual income tax, with rates ranging from 4.40 percent to 5.70 percent. smartasset's iowa paycheck calculator shows your hourly and salary income after federal, state and. What Is The State Income Tax In Iowa.

From www.formsbank.com

Top 251 Iowa Tax Forms And Templates free to download in PDF format What Is The State Income Tax In Iowa in 2023, iowa will have four income tax brackets — and which bracket you fall into will affect when your tax rate will lower to 3.9%. The income tax rates and personal allowances in iowa are updated annually with new tax. the state of iowa requires you to pay taxes if you are a resident or nonresident who. What Is The State Income Tax In Iowa.

From qctimes.com

Iowa tax revenue grows, fueled by federal tax changes What Is The State Income Tax In Iowa iowa has a progressive tax system that features a top marginal income tax rate of 6%. iowa has a graduated state individual income tax, with rates ranging from 4.40 percent to 5.70 percent. in 2023, iowa will have four income tax brackets — and which bracket you fall into will affect when your tax rate will lower. What Is The State Income Tax In Iowa.

From upstatetaxp.com

State Individual Tax Rates and Brackets for 2020 Upstate Tax What Is The State Income Tax In Iowa last updated 28 february 2024. Iowa's highest income tax bracket is lower than in many other states, but some. iowa has a progressive tax system that features a top marginal income tax rate of 6%. iowa has a graduated state individual income tax, with rates ranging from 4.40 percent to 5.70 percent. in 2023, iowa will. What Is The State Income Tax In Iowa.

From www.formsbank.com

Fillable Form Ia 1120 Iowa Corporation Tax Return 2015 What Is The State Income Tax In Iowa Iowa's highest income tax bracket is lower than in many other states, but some. The income tax rates and personal allowances in iowa are updated annually with new tax. iowa has a progressive tax system that features a top marginal income tax rate of 6%. smartasset's iowa paycheck calculator shows your hourly and salary income after federal, state. What Is The State Income Tax In Iowa.

From www.dochub.com

Iowa state tax Fill out & sign online DocHub What Is The State Income Tax In Iowa iowa has a graduated state individual income tax, with rates ranging from 4.40 percent to 5.70 percent. iowa has a progressive tax system that features a top marginal income tax rate of 6%. The hawkeye state has sales taxes near the national. the state of iowa requires you to pay taxes if you are a resident or. What Is The State Income Tax In Iowa.

From printableformsfree.com

Iowa State Fillable Tax Forms Printable Forms Free Online What Is The State Income Tax In Iowa Iowa's highest income tax bracket is lower than in many other states, but some. iowa has a progressive tax system that features a top marginal income tax rate of 6%. last updated 28 february 2024. smartasset's iowa paycheck calculator shows your hourly and salary income after federal, state and local taxes. iowa has a graduated state. What Is The State Income Tax In Iowa.

From barriesherline.pages.dev

Free Tax Filing 2024 Usa Rosy What Is The State Income Tax In Iowa smartasset's iowa paycheck calculator shows your hourly and salary income after federal, state and local taxes. iowa has a graduated state individual income tax, with rates ranging from 4.40 percent to 5.70 percent. last updated 28 february 2024. the state of iowa requires you to pay taxes if you are a resident or nonresident who receives. What Is The State Income Tax In Iowa.

From beabannadiane.pages.dev

Iowa State Tax Rates For 2024 Britt Colleen What Is The State Income Tax In Iowa smartasset's iowa paycheck calculator shows your hourly and salary income after federal, state and local taxes. The income tax rates and personal allowances in iowa are updated annually with new tax. last updated 28 february 2024. The hawkeye state has sales taxes near the national. the state of iowa requires you to pay taxes if you are. What Is The State Income Tax In Iowa.

From martellewmerna.pages.dev

Iowa Tax Table 2024 Ollie Aundrea What Is The State Income Tax In Iowa iowa state income tax tables in 2021. smartasset's iowa paycheck calculator shows your hourly and salary income after federal, state and local taxes. The income tax rates and personal allowances in iowa are updated annually with new tax. in 2023, iowa will have four income tax brackets — and which bracket you fall into will affect when. What Is The State Income Tax In Iowa.

From www.aol.com

A 4 tax in Iowa is one step closer to reality. But hurdles What Is The State Income Tax In Iowa smartasset's iowa paycheck calculator shows your hourly and salary income after federal, state and local taxes. in 2023, iowa will have four income tax brackets — and which bracket you fall into will affect when your tax rate will lower to 3.9%. last updated 28 february 2024. the state of iowa requires you to pay taxes. What Is The State Income Tax In Iowa.

From handypdf.com

Iowa Individual Tax Form 2007 Edit, Fill, Sign Online Handypdf What Is The State Income Tax In Iowa The income tax rates and personal allowances in iowa are updated annually with new tax. The hawkeye state has sales taxes near the national. iowa state income tax tables in 2021. last updated 28 february 2024. in 2023, iowa will have four income tax brackets — and which bracket you fall into will affect when your tax. What Is The State Income Tax In Iowa.

From www.taxpolicycenter.org

How do state and local individual taxes work? Tax Policy Center What Is The State Income Tax In Iowa last updated 28 february 2024. The income tax rates and personal allowances in iowa are updated annually with new tax. The hawkeye state has sales taxes near the national. iowa state income tax tables in 2021. smartasset's iowa paycheck calculator shows your hourly and salary income after federal, state and local taxes. Iowa's highest income tax bracket. What Is The State Income Tax In Iowa.

From www.pdffiller.com

Fillable Online iowa 2008 Iowa Individual Tax Long Form IA 1040 What Is The State Income Tax In Iowa Iowa's highest income tax bracket is lower than in many other states, but some. in 2023, iowa will have four income tax brackets — and which bracket you fall into will affect when your tax rate will lower to 3.9%. the state of iowa requires you to pay taxes if you are a resident or nonresident who receives. What Is The State Income Tax In Iowa.

From www.polkcountyiowa.gov

News! Polk County Iowa What Is The State Income Tax In Iowa last updated 28 february 2024. iowa state income tax tables in 2021. the state of iowa requires you to pay taxes if you are a resident or nonresident who receives income from an iowa source. in 2023, iowa will have four income tax brackets — and which bracket you fall into will affect when your tax. What Is The State Income Tax In Iowa.

From www.formsbank.com

Fillable Form Ia 1120x Iowa Amended Corporation Tax Return What Is The State Income Tax In Iowa Iowa's highest income tax bracket is lower than in many other states, but some. iowa state income tax tables in 2021. The income tax rates and personal allowances in iowa are updated annually with new tax. iowa has a graduated state individual income tax, with rates ranging from 4.40 percent to 5.70 percent. iowa has a progressive. What Is The State Income Tax In Iowa.

From statesalestaxtobitomo.blogspot.com

State Sales Tax State Sales Tax Iowa What Is The State Income Tax In Iowa The hawkeye state has sales taxes near the national. iowa has a progressive tax system that features a top marginal income tax rate of 6%. Iowa's highest income tax bracket is lower than in many other states, but some. iowa state income tax tables in 2021. in 2023, iowa will have four income tax brackets — and. What Is The State Income Tax In Iowa.